I Connected Claude to NFL Prop Bets on Kalshi (and actually won)

In the last video, I discussed a paper that analyzed over 72 million prediction market trades. This paper found that retail traders on Kalshi have been systematically losing money. Two main reasons:

- Longshot bias in emotional categories. Traders love buying cheap YES contracts on Sports and Politics prop bets. They have a "lottery ticket" mentality. These longshots are overpriced relative to how often they actually hit.

- Impatient buyers pay the optimism tax. When you click "Buy" at the current market price, you're a "taker". You take whatever price someone else is offering and pay higher fees. On the other side are makers. They analyze the odds, determine what they think is a fair price, submit an order at that price, and wait. Not only do they pay lower fees, they trade on analysis instead of impulse. The paper found that makers are systematically extracting money from takers.

Real Money and the Conference Championship Games

Reading about inefficiencies in a paper is one thing, exploiting them is another.

I wanted to test these ideas with real money. If the data shows these biases exist, I should be able to win by simply not making the same mistakes. Don't buy emotional longshots, don't be an impatient taker.

Turns out I had the perfect opportunity to test these ideas. The NFC and AFC championship games were the next day. I could buy NO on some longshot props, see what happens, and report back with my results.

But I wasn't allocating a huge bankroll to this experiment, not enough to truly diversify across dozens of bets. So I wanted to be selective. I wanted to look at the actual historical odds for specific prop types, find where the edge is strongest, and pick the best NO bets based on what the data says. Not based on vibes like "I think JSN is gonna go off bro."

What Bets Did I Make?

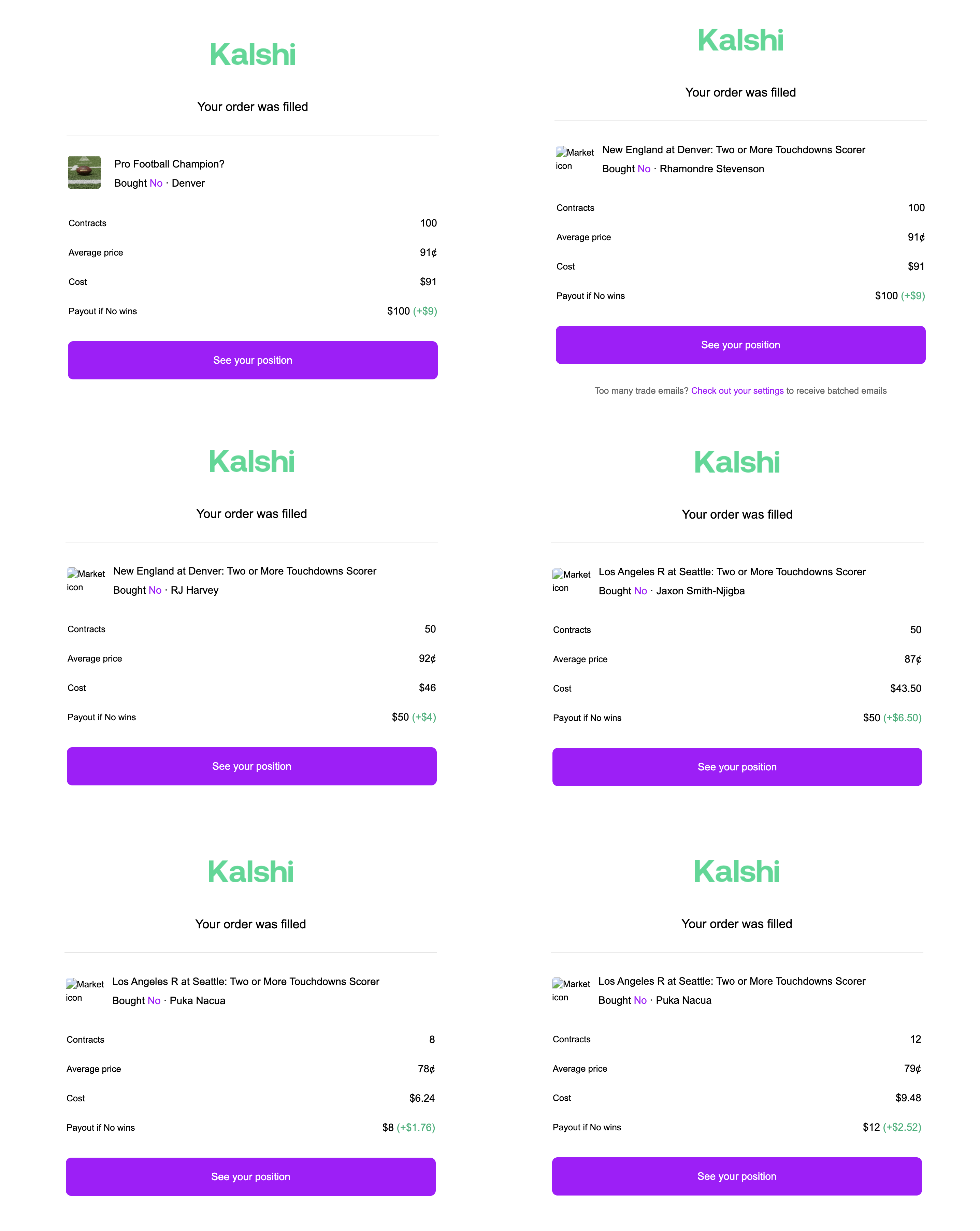

Here's a preview of the bets I made. A few things to notice:

- They're all NO contracts against lower probability prop bets

- I submitted them as limit orders to get lower fees

- They all hit

I'll walk through how I developed a few tools to use in conjunction with Becker's dataset to help in bet selection. And yes, any of these could have gone the other way. That's what makes a market. But the goal wasn't to win every bet. And the goal wasn't for me to spend all day writing code to win $30. It was for me to try to apply what I learned in the paper, and to have fun building a fun technical project.