Automating Investment Research with Perplexity Finance

Perplexity Finance is an AI-powered financial research tool developed by Perplexity AI. It is designed to make stock market analysis and company research faster, more transparent, and accessible to everyone from retail investors to professionals. Its core strength is the integration of real-time, credible market data with advanced AI reasoning and easy-to-use natural language querying.

In this tutorial, I’ll walk you through some of the newest features, including the Earnings Hub, Live Transcripts, Perplexity Tasks, Price Alerts, and Coinbase integration. I’ll also share a set of highly practical prompts you can use to automate your investment research using Perplexity Tasks.

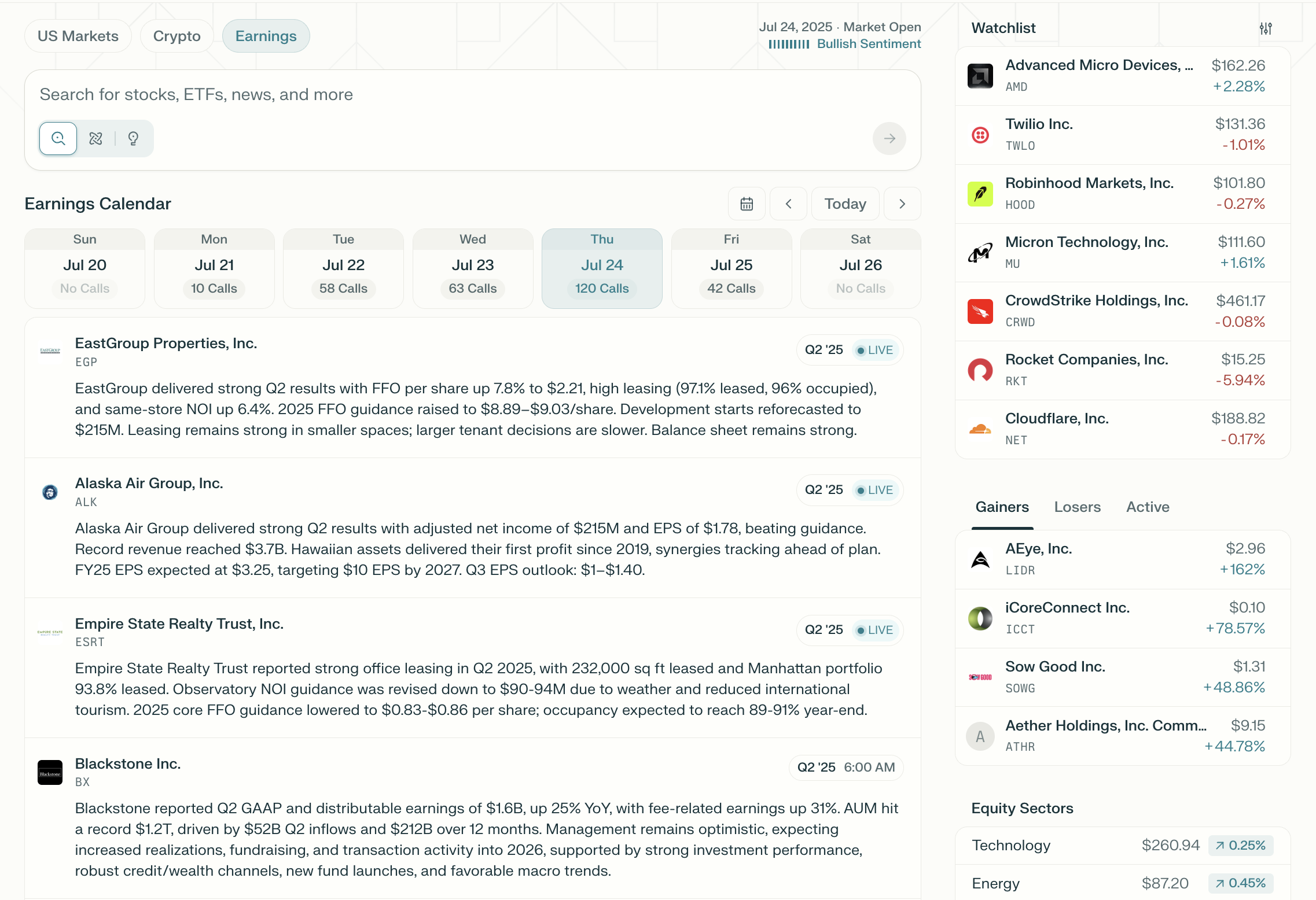

Earnings Hub

The new Perplexity Earnings Hub is a centralized dashboard on Perplexity Finance that aggregates upcoming and past US company earnings reports. It offers a calendar view to track earnings events and provides instant synthesis of earnings calls as they happen. This allows you as an investor to easily monitor companies’ earnings schedules to plan trades and portfolio adjustments.

Live Transcripts

One of the coolest features of the earnings hub is the live transcripts. As company's report earnings, you get real-time transcription and summarization of ongoing earnings calls. Perplexity automatically extracts insights and key metrics such as revenue, EPS, and management discussion while the call is still in session.

This saves valuable time since you can skip live audio and instead get instant transcripts and AI-generated summaries. You can respond quickly to market news and trade or adjust positions as major financial announcements are made, rather than waiting for traditional media delays.

You can also use the structured breakdown of earnings (including Q&A highlights) to inform investment and trading decisions without wading through hours of audio or dense filings. If you aren't interested in AI-generated analysis, you can view the slides and PDF reports if you want to read source material or process them with your own AI system and workflow.

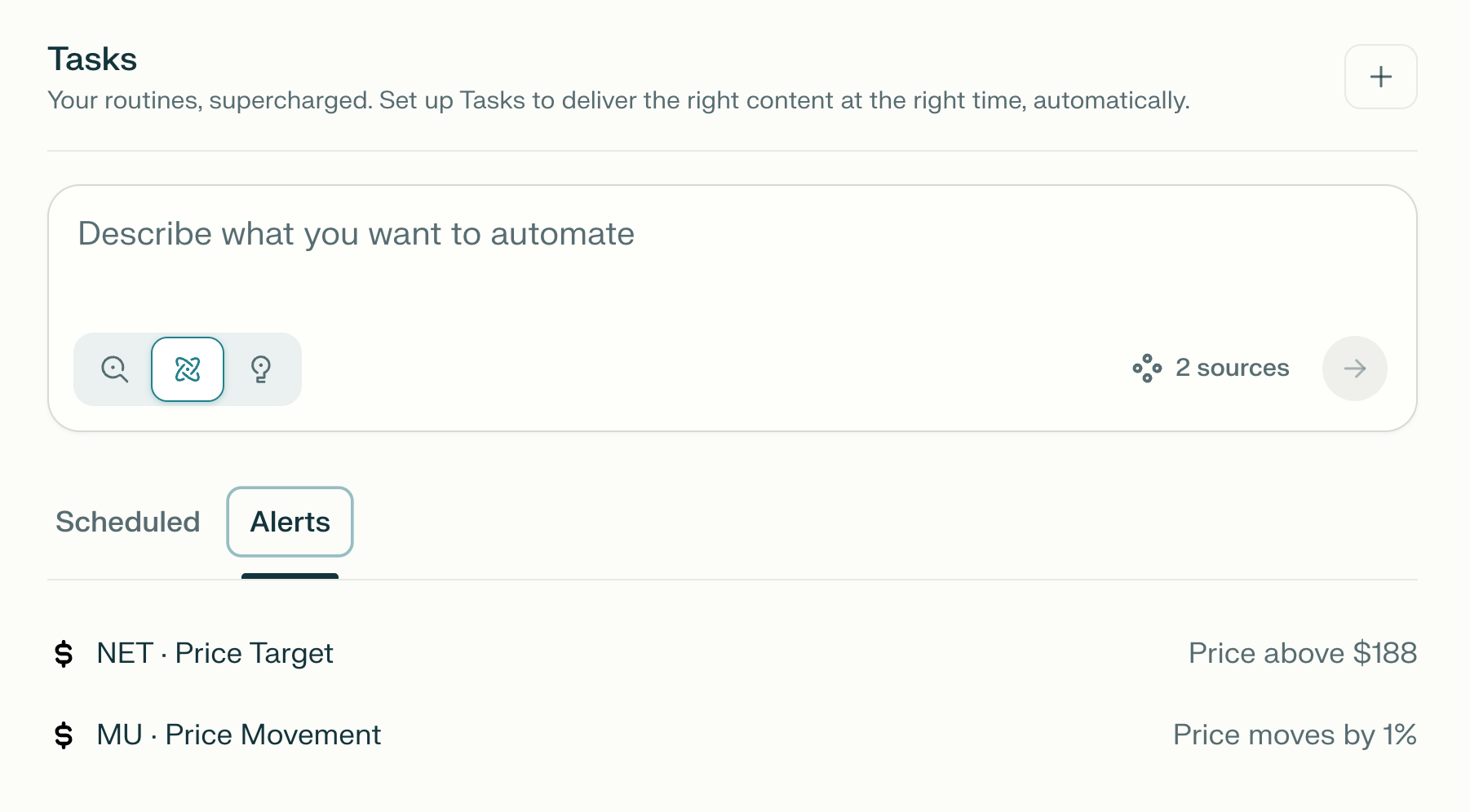

Perplexity Tasks

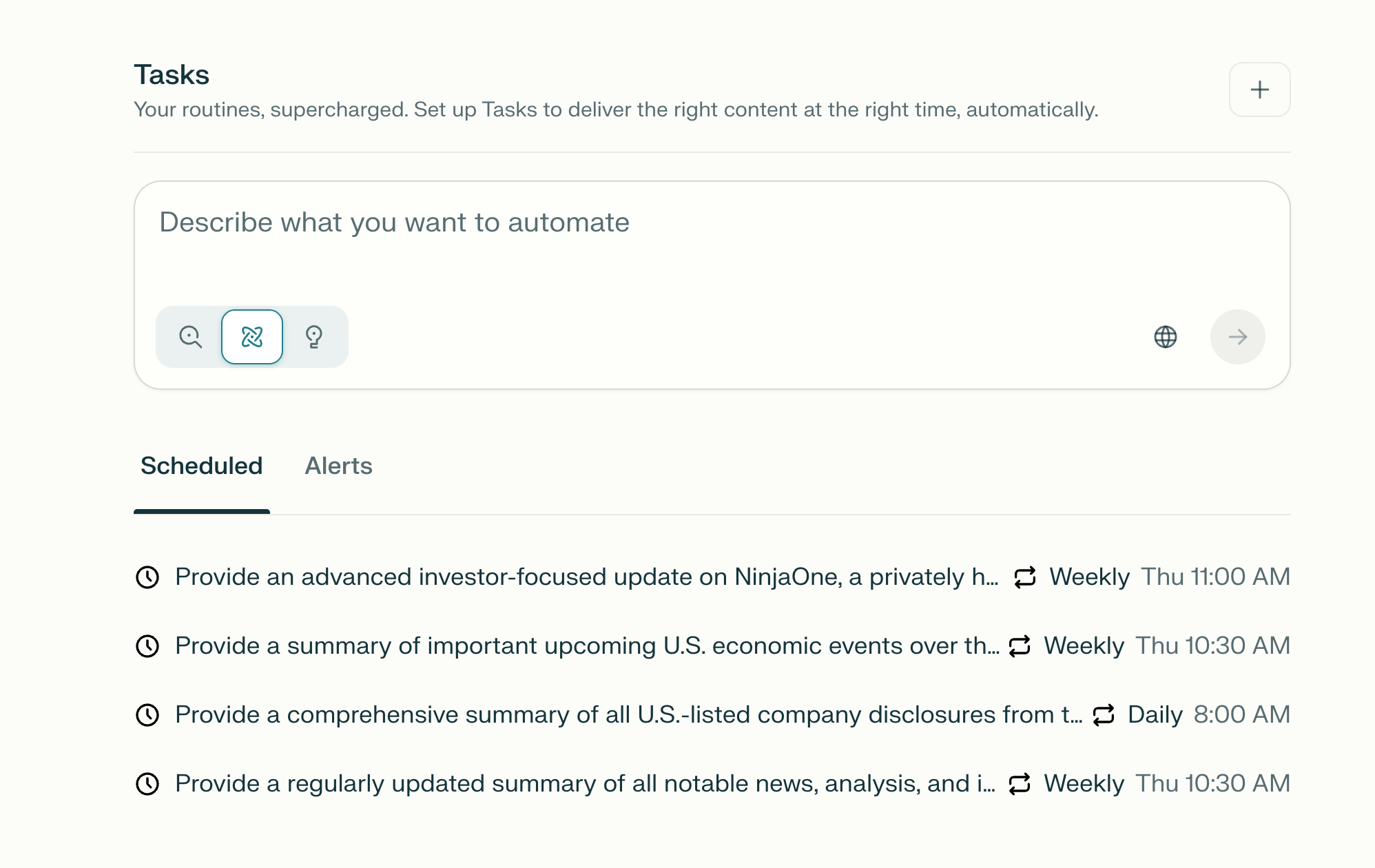

Perplexity Tasks is a workflow automation and alerting feature that allows users to create personalized, recurring queries (Tasks) on financial topics, companies, or market triggers. Tasks can deliver actionable updates via email or push notifications on your chosen schedule.

With Tasks you can:

- Set up daily or weekly summaries for your portfolio companies or market sectors you care about.

- Automatically receive news digests, price movement alerts, or even custom research reports.

- Archive and review tasks in your account library, keeping all your alerts and research threads organized.

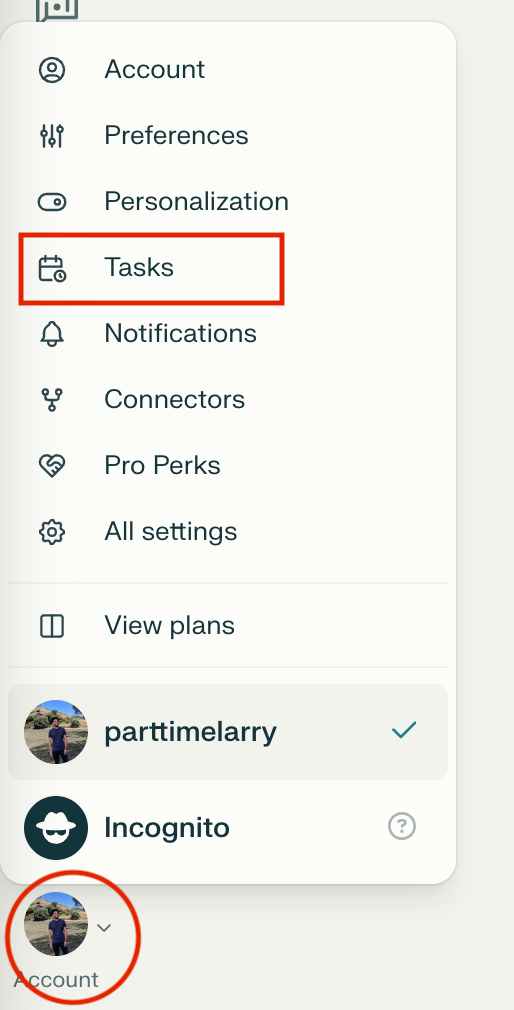

To use tasks, click on your Account icon in the lower left, and select Tasks in the menu:

This will take you to a screen where you can create new tasks. To schedule a new task, you first describe the task you want to automate in the form of a prompt. You can either schedule it as a quick search or a deep research task. You can also choose whether to search the web, academic papers, social discussions, or SEC filings.

Then you just tell Perplexity the frequency to run the task and it will run it on a schedule. You can choose to run a task just once, daily, weekly, monthly, or yearly.

Use Cases

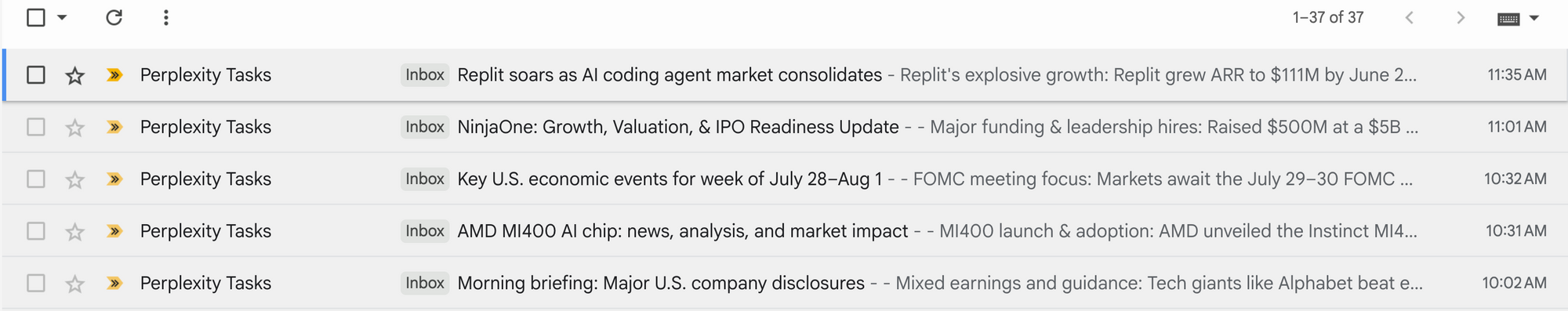

How might you use this functionality? Below I have included a laundry list of prompts that I have used to follow both public and private companies, their new products and features, emerging technology trends, both US and Global economic calendar events, upcoming IPO's, and my own portfolio. All of these are delivered directly to my inbox:

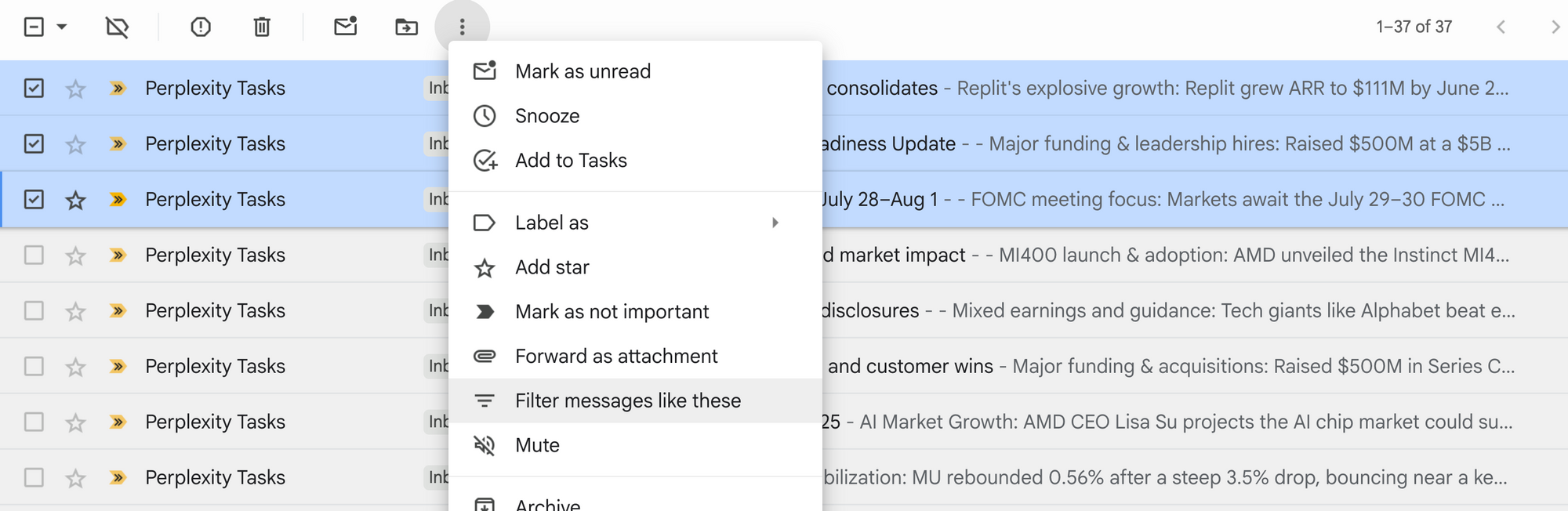

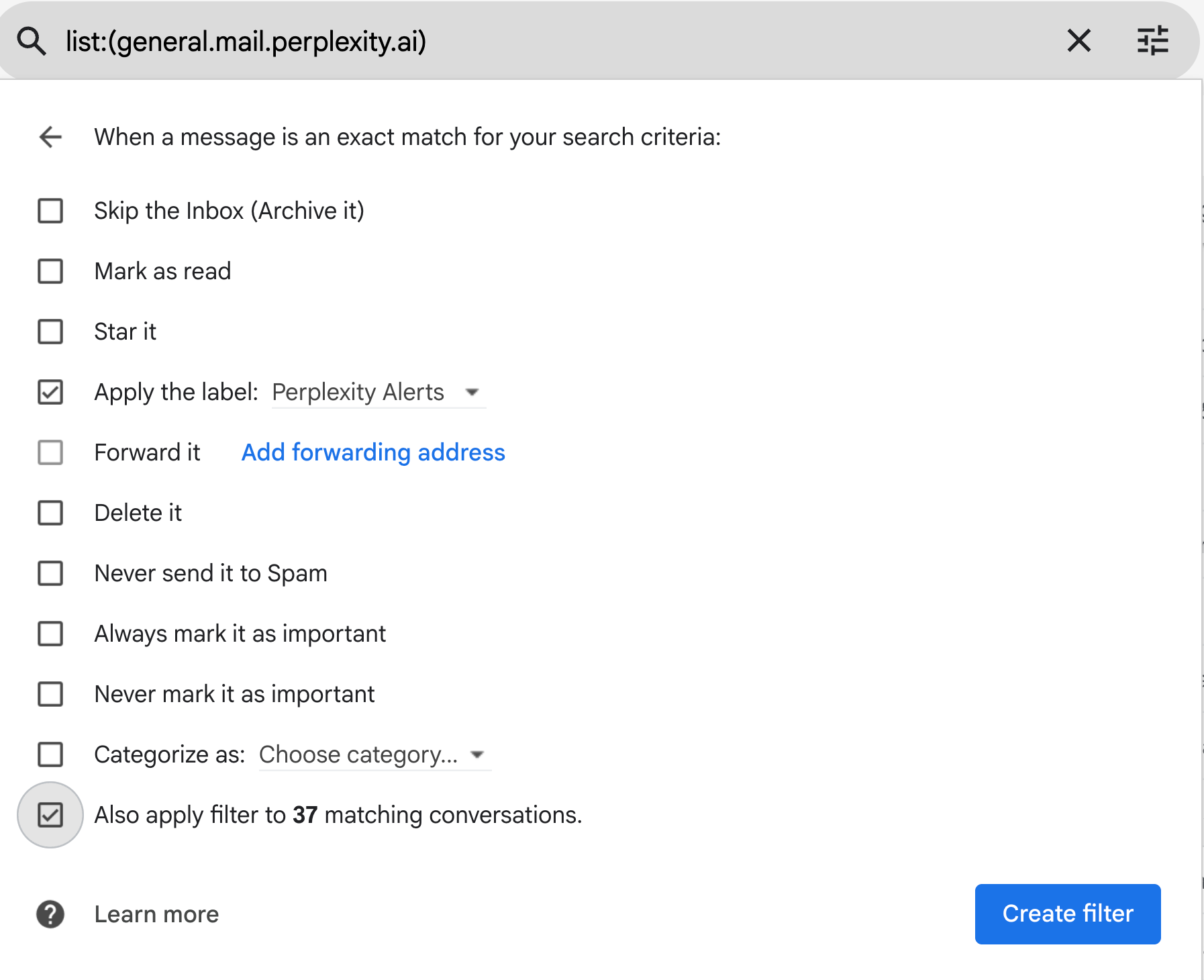

Staying Organized

To keep my inbox organized in Gmail, I simply create a filter for messages like this and automatically apply a label them:

Prompts for Specific Public Companies / Products

Cloudflare (NET) Edge Computing & Product Ecosystem Update

Prompt:

Provide an ongoing briefing on Cloudflare’s product evolution, ecosystem growth, and strategic positioning in edge computing, with a focus on developments since the launch of its latest AI, serverless, and security products.

For each update, include:

1. New product announcements or upgrades (e.g. Workers, R2, KV, D1, Durable Objects, Zero Trust stack),

2. Ecosystem growth — adoption by key customers (e.g. Stripe, Reddit), developer usage metrics, or integrations with major platforms,

3. Competitive positioning vs. AWS, Azure, or Fastly in edge compute, storage, and security,

4. Analyst upgrades/downgrades or hedge fund positioning changes that cite edge momentum,

5. Market reception to product changes (revenue growth breakdown by segment, margin trends, pricing model shifts),

6. Strategic expansions (PoP expansion, data center partnerships, new global regions),

7. Any commentary from executives (CEO Matthew Prince, CTOs) on edge AI or distributed infrastructure.

Finish with a short investor-grade analysis of Cloudflare’s evolving moat, including whether it is strengthening, facing headwinds, or seeing increasing competitive threats. Prioritize signal over noise.Twilio AI Strategy and Product Evolution

Prompt:

Provide a focused update on Twilio’s (TWLO) AI-powered customer engagement strategy, product developments, financial performance, and market positioning.

For each update, include:

1. New product announcements, features, or upgrades related to Twilio’s AI offerings (e.g. ConversationRelay, Conversational Intelligence, Customer Data Platform, TCPA tools),

2. Adoption examples from enterprise customers or major case studies (e.g. Cedar, healthcare, fintech, global messaging expansions),

3. Financial updates: revenue growth, guidance changes, margin trends, net expansion rate, and cash flow,

4. Analyst upgrades/downgrades, hedge fund positioning, and valuation commentary (P/S, P/E, forward growth outlook),

5. Competitive landscape updates (RingCentral, Bandwidth, Vonage) and how Twilio’s positioning compares,

6. New data on addressable market trends in AI-powered communications, CPaaS, or omnichannel orchestration,

7. Executive commentary from Jeff Lawson or Twilio leadership about long-term AI or platform vision.

Conclude with a concise summary of Twilio’s AI-driven growth momentum and whether investor sentiment is strengthening, cautious, or at an inflection point. Prioritize updates relevant to long-term investors evaluating Twilio as a growth stock.AMD MI400 AI Chips – Competitive & Market Update

Prompt:

Provide a regularly updated summary of all notable news, analysis, and investor commentary related to AMD’s MI400 AI chip series. For each update, include:

1. New announcements or technical developments related to the Instinct MI400 chips and Helios rack system,

2. Any public mentions from OpenAI, Sam Altman, or other large customers or hyperscalers confirming usage or testing,

3. Competitive comparison with Nvidia’s latest offerings (e.g. Blackwell architecture),

4. Investor reactions or analyst upgrades/downgrades that mention MI400,

5. Shipment timelines or partnerships for MI400 deployments,

6. Impact of MI400 on AMD’s stock price or valuation, including relative performance vs. Nvidia,

7. Any new data suggesting AMD is gaining market share in AI/accelerated compute.

Summarize with a brief analysis of how AMD’s AI positioning is evolving and whether sentiment appears to be turning more bullish or still skeptical.Prompts for Private Companies / Emerging Trends

Emerging Startup and Trend: Replit and AI Coding Agents

Prompt:

Provide an advanced intelligence briefing on Replit and the rapidly evolving AI coding agent ecosystem, with an emphasis on platform economics, competitive landscape, and paradigm-shifting product trends.

For Replit, include:

1. ARR and Growth Metrics: Any new disclosures or credible estimates of Replit's revenue, user base (total, paying), usage, or enterprise traction.

2. Product Evolution: Updates to Replit Agent, AI-native app generation, no-code/low-code tools, usage-based pricing model, or new features like deployment, hosting, or data modeling.

3. Customer Use Cases: Highlight enterprise use (e.g. Zillow, HubSpot) and new examples of Replit used for real-world applications.

4. Platform Strategy: Coverage on Replit’s integrated full-stack environment and its ability to serve both non-technical and advanced developers.

5. Ecosystem Activity: User-generated app metrics (e.g. # of projects created), marketplace growth, and network effect indicators (templates, repos).

6. Funding & Valuation: Any secondary sales, new funding, investor commentary, or IPO preparation signals.

7. Risks or Constraints: Reliance on Claude or Anthropic, scaling challenges, security, or infrastructure updates.

8. Executive Commentary: Posts or interviews from Amjad Masad or Replit leadership that reflect strategic vision or key shifts.

9. Community & PLG Signals: Indicators of developer sentiment, viral growth, education use, and community momentum.

For the broader AI coding agent space, include updates on:

– Cursor (Anysphere): Growth milestones, valuation moves, product roadmap, pricing shifts.

– GitHub Copilot: ARR updates, integration expansion, Microsoft strategy changes.

– Lovable: GUI-focused AI app builder traction, funding, design/developer adoption.

– Windsurf (Codeium): Post-acquisition product positioning under OpenAI, enterprise features.

– Vercel / v0: Product focus, AI assistant strategy, ARR updates.

– Any new players entering or consolidating the space, especially with unique AI-native development models.

– Vibe Coding Trend Signals: Coverage of new AI-first IDEs, citizen developer tools, or “natural language to app” interfaces.

– VC Activity: Notable fundings, valuations, and investor commentary shaping the ecosystem.

– Market Shifts: Commentary on AI’s impact on the $500B+ traditional software development market.

Conclude with a forward-looking analysis on whether Replit’s trajectory is accelerating or encountering friction, and how the broader market for AI app development platforms is evolving. Highlight breakout companies, momentum shifts, and early signs of commoditization or consolidation.Private Investor in a Specific Cybersecurity Company: NinjaOne

Prompt:

Provide an advanced investor-focused update on NinjaOne, a privately held IT management and endpoint security company.

Structure the report across the following key dimensions:

1. News & Public Mentions

– Summarize notable press coverage, blog posts, podcasts, or CEO/executive interviews.

– Include any mentions in industry analyst reports, Gartner/Forrester citations, or trade publications.

– Track buzz from developer/security communities, job boards, or employee review sites (e.g., Blind, Glassdoor).

2. Funding & Valuation Signals

– Identify any new fundraising activity (confirmed or rumored), secondary share sales, or 409A valuation updates.

– Highlight institutional interest, board additions, or crossover investor signals that suggest IPO readiness.

– Flag any M&A speculation or private equity interest.

3. Product Roadmap & Feature Launches

– Report on new product lines, modules, or platform expansions (e.g. security tools, automation, mobile device support).

– Include improvements to RMM (remote monitoring & management), patching, backup, endpoint protection, etc.

– Note developer ecosystem growth (API, integrations, community traction).

4. Customer Wins & Go-to-Market Momentum

– Identify any publicly announced major customers or government contracts.

– Track large partner integrations, reseller programs, or MSP endorsements.

– Monitor Glassdoor, LinkedIn, or job listings for signals of sales expansion or enterprise focus.

5. Growth Indicators & Strategic Trajectory

– Surface estimated ARR (annual recurring revenue), YoY growth rates, or employee count changes.

– Track leadership hires in marketing, finance, or legal (especially IPO-facing roles like GC or CFO).

– Identify signs of international expansion, enterprise move-upmarket, or bundling strategy.

6. Market Context & Competitive Landscape

– Summarize any developments from direct competitors (e.g., Atera, Datto, N-able, ConnectWise, SentinelOne) that affect positioning.

– Highlight trends in IT automation, remote endpoint management, and SMB security that could expand or contract NinjaOne’s TAM.

– If applicable, include commentary on IPO market conditions for security/infra SaaS companies.

Conclude with a forward-looking investor brief summarizing NinjaOne’s momentum, IPO readiness, and whether risk/reward is improving, stabilizing, or deteriorating.Prompts For Overall Public Market

Morning Digest of Material Disclosures

Prompt:

Provide a comprehensive summary of all U.S.-listed company disclosures from the past 24 hours. Focus on:

1. Price-sensitive announcements (e.g., earnings results, guidance updates, unexpected news),

2. Mergers, acquisitions, or divestitures,

3. Trading updates and profit warnings,

4. Insider transactions and significant ownership changes (Form 4, 13D/G),

5. Dividend announcements,

6. Annual and quarterly financial results (Forms 10-K and 10-Q), and

7. Major SEC Form 8-K filings.

For each significant disclosure, include the company ticker, announcement type, key details, and potential market impact. Present this as a concise and digestible morning briefing.U.S. Economic Calendar Digest

Prompt:

Provide a summary of important upcoming U.S. economic events over the next 7 days. Focus on:

1. Federal Reserve announcements (FOMC meetings, rate decisions, speeches),

2. Inflation data (CPI, PPI, PCE),

2. Labor market data (nonfarm payrolls, unemployment rate, jobless claims),

3. GDP releases,

5. Retail sales, consumer sentiment, and housing data,

6. Treasury auctions or major fiscal updates.

For each event, include the date/time, expected vs. prior values (if available), and why it matters for markets. Format this as a concise briefing suitable for a morning investor readout.Global Macro Calendar Digest

Prompt:

Provide a summary of significant global macroeconomic events scheduled for the next 7 days. Focus on:

1. Central bank announcements (ECB, BOJ, PBOC, RBA, Bank of Canada, etc.),

2. Key inflation, GDP, and unemployment releases across major economies (U.S., Eurozone, China, Japan, UK),

3. PMIs, trade balance data, and major geopolitical/energy-related developments,

4. Any G7/G20 summits or major fiscal policy shifts.

For each event, include:

– Country/region and event name

– Date/time and expected vs. prior data (if available)

– A short note on how this might influence global risk sentiment or asset classes, including equities, bonds, and currencies.

Prioritize events likely to move markets. Present this as a global macro digest suitable for multi-asset investors.Prompts For Trackers

Congressional Trades

Prompt:

Provide a daily (or weekly) briefing on recent congressional stock trades disclosed via the U.S. STOCK Act (Senate and House financial disclosures).

For each reported transaction, include:

1. Member name and party/state affiliation

2. Stock or security traded, including ticker symbol

3. Buy/sell indicator and estimated transaction amount

4. Date of transaction and filing delay (days between trade and disclosure)

5. Any committee affiliations or potential policy conflicts related to the trade (e.g. energy, tech, defense, health)

6. Trade history or pattern if the member has a recurring relationship with the security

Highlight:

– Trades over $50,000

– Activity by frequent traders (e.g. Pelosi, Tuberville, Hickenlooper, etc.)

– Unusual or clustered buying/selling across multiple members

Conclude with a summary of sectors seeing the most congressional activity and whether buying/selling trends are emerging among lawmakers.Social Arb

Prompt:

Provide a daily (or weekly) briefing of emerging social, cultural, or viral trends that may influence publicly traded consumer-facing companies.

Focus on:

1. Celebrity or influencer endorsements, collaborations, or viral moments tied to brands (e.g., actors, athletes, creators, musicians)

2. TikTok, Instagram, or X trends driving unexpected spikes in product demand or brand visibility

3. Fashion, lifestyle, or beauty movements (e.g., “clean girl aesthetic,” “quiet luxury”) that may benefit or harm retailers, beauty brands, or apparel companies

4. Consumer sentiment shifts in forums like Reddit, Discord, or Twitter toward specific brands, stores, or products

5. Pop culture events (e.g., movie/TV show releases, viral music videos, awards shows) that affect stock performance of entertainment, retail, or travel companies

For each trend, include:

– The trigger event or viral moment

– The associated company or stock (e.g., American Eagle, Ulta, LVMH, Mattel)

– The platforms driving the trend (e.g., TikTok, X, Reddit)

– A brief summary of the potential investment relevance (e.g., brand boost, sellout risk, influencer halo effect)

– Any unusual volume or price action already observed

Highlight signals that may indicate a temporary pop (e.g., merchandise hype), a sustainable cultural shift (e.g., Gen Z brand adoption), or reputational risk. Prioritize early-stage signals before they're fully priced into markets.Hot Hands

Prompt:

Provide an ongoing investor-focused briefing on notable activity from high-profile or high-performing investors, thematic fund managers, or rising star institutions that are currently influencing market sentiment.

Focus on:

1. Recent 13F, Form 4, or institutional filings showing buys/sells from well-followed investors (e.g., Tiger Global, Coatue, Bill Ackman, Stanley Druckenmiller, Renaissance Technologies, etc.)

2. Portfolio changes by thematic ETF managers or solo breakout figures (e.g., Cathie Wood / ARK Invest, Nancy Davis / Quadratic, Eric Balchunas’s “ETF of the week” mentions)

3. High-visibility conviction buys — large or concentrated new positions in small/mid-cap names, turnaround plays, or emerging tech

4. Media and social signals — interviews, tweets, podcasts, or YouTube clips where investors make bold calls or reveal positioning

5. Performance-based filters — highlight those outperforming peers or benchmark YTD (based on available fund or public data)

For each signal, include:

– Investor name and style (e.g. growth, macro, sector-focused)

– Trade or thesis (ticker, direction, size if known)

– Date and source (filing, interview, post)

– Summary of market reaction or potential second-order effects

Bonus: Highlight any emerging “Cathie Wood-style” influencers whose trades are consistently followed by retail or institutions and are generating noticeable stock movement.

Conclude with a short readout of which names are showing up repeatedly across hot hands, suggesting growing consensus or momentum.Insider Trading Watch and Unusual Transactions

Prompt:

Scan all insider trading disclosures (Form 4 filings) from the past 48 hours and identify noteworthy insider transactions in U.S.-listed companies. Focus on:

1. Director or C-suite purchases – flag any large or first-time purchases, purchases made during downturns, or purchases in clusters.

2. Unusual or clustered sales – flag any large, frequent, or pattern-based sales (e.g., multiple insiders selling in a short period or significant dollar value).

For each flagged transaction, provide:

– Company name and ticker

– Insider’s name and role

– Transaction type (buy/sell), number of shares, and total dollar amount

– Stock price at time of transaction

– Context or commentary on whether the trade appears bullish, bearish, or neutral

Prioritize trades that could signal shifts in sentiment, valuation conviction, or hidden catalysts. Present as a concise alert-style briefing.IPO Tracker

Prompt:

Provide a summary of all recent and upcoming IPOs in the U.S. stock market over the past 7 days and the week ahead.

For each IPO, include:

1. Company name and ticker symbol

2. Listing date (or expected listing date)

3. IPO offer price and number of shares offered

4. Current stock price (if already listed)

5. Brief business description (1–2 sentences max)

6. Sector/industry classification

7. Underwriters (if notable)

8. Any notable investors or valuation at IPO

9. A short analysis of market reception or sentiment (e.g., “well-received,” “trading below offer,” “highly anticipated”)

Format as a digestible investor briefing and prioritize IPOs with high visibility or significant market impact.Portfolio Specific Prompts

Weekly U.S. Portfolio Summary

Prompt:

Create a comprehensive weekly performance report for the following U.S.-listed portfolio stocks. For each stock, include:

1. Weekly price performance (5-day price change),

2. Key news and developments (e.g., press releases, SEC filings like 8-Ks or earnings),

3. Analyst rating changes or target price adjustments,

4. Upcoming earnings or events, and

5. Technical summary (trends, momentum, resistance/support).

Finish with a U.S. market outlook for the coming week and any notable sector trends that may affect these holdings.

Portfolio Stocks:

Apple [AAPL]

Nvidia [NVDA]

Pfizer [PFE]

Alphabet [GOOGL]

Visa [V]

Tesla [TSLA]SEC Filing Digest for Portfolio

Prompt:

Summarize all major SEC EDGAR filings (Forms 8-K, 10-Q, 10-K, S-1, 13D/G, Form 4) from the following companies in the past 5 days. Focus on key business developments, insider trades, financial results, and risk disclosures. Format each summary with the ticker, filing type, a short summary, and why it matters to investors.

Portfolio Stocks:

Apple [AAPL]

Nvidia [NVDA]

Pfizer [PFE]

Alphabet [GOOGL]

Visa [V]

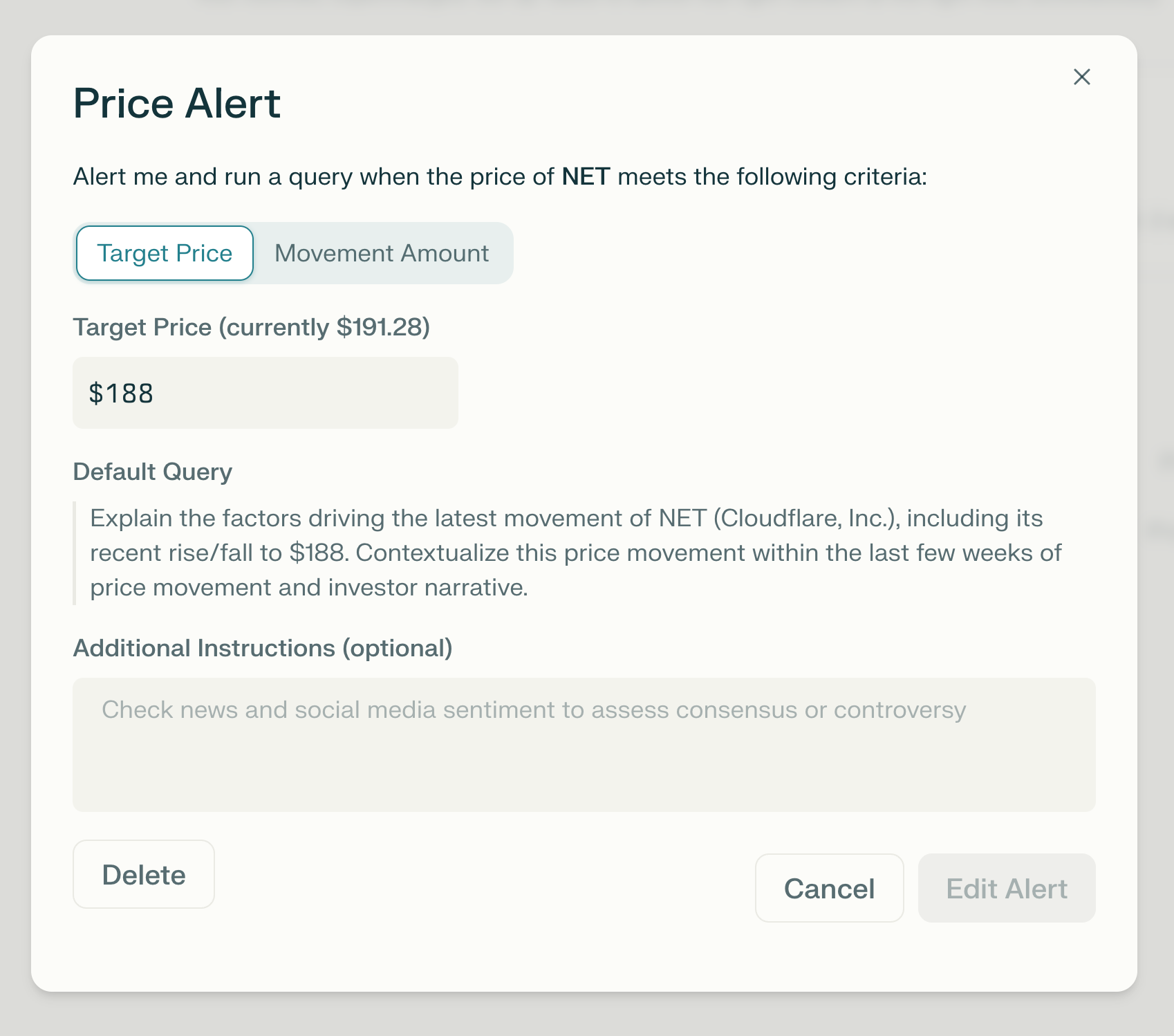

Tesla [TSLA] Price Alerts

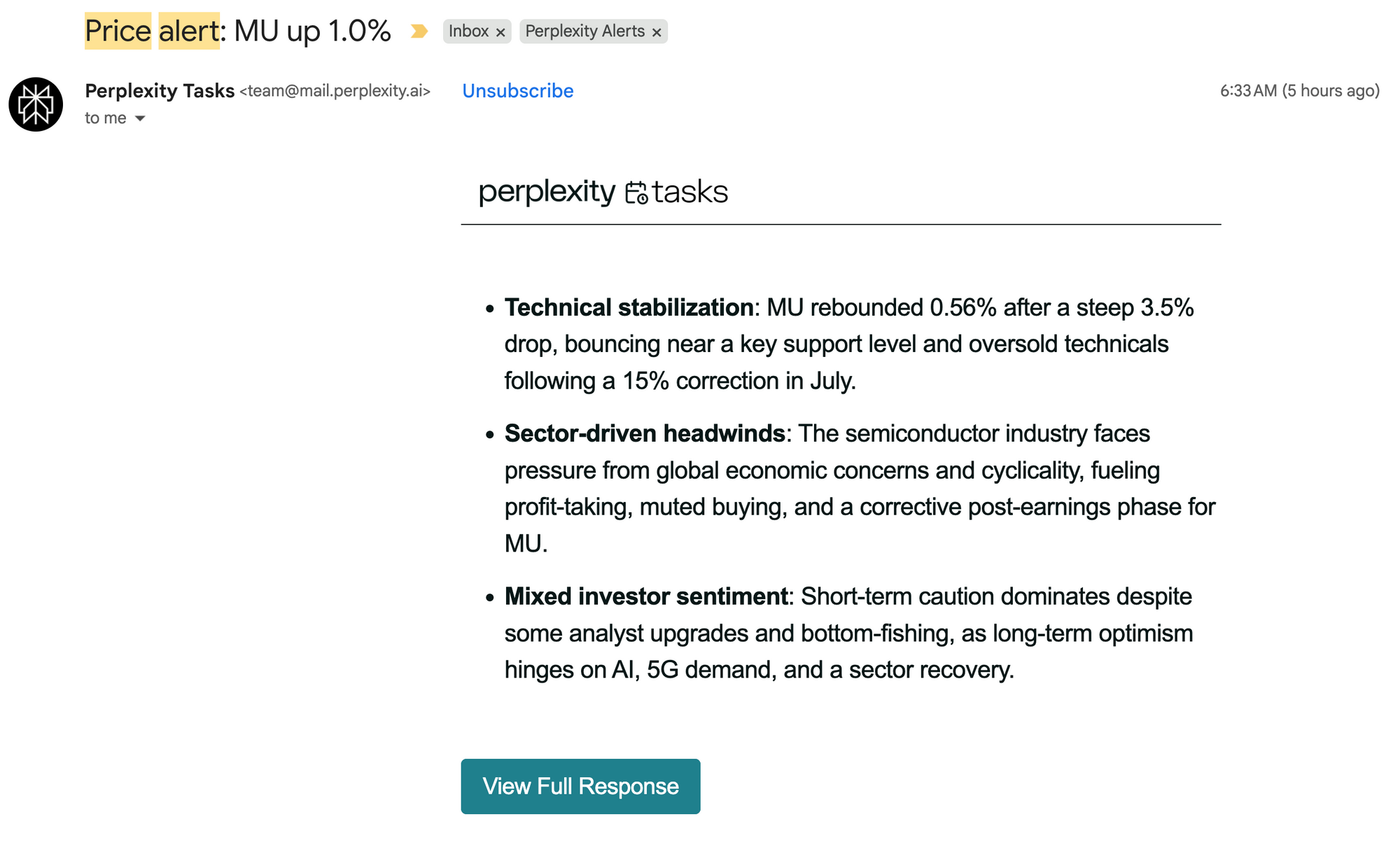

With the Price Alerts feature, you can configure custom push and email notifications tied to specific price triggers:

Use Cases

- Stay on top of critical price moves or breaking developments without constantly checking dashboards or news feeds.

- Set alerts for technical or fundamental signals you care about (e.g., price crossing a moving average, new analyst ratings, sector news).

- Use as a modern, AI-powered replacement for Google Alerts to efficiently monitor holdings or watchlists for relevant changes.

It would be cool if Perplexity added webhooks as a feature to both Perplexity Tasks and price alerts so that you could process the signals yourself. This would open up powerful workflows and user-defiend use cases that may not be possible directly within Perplexity. For instance, in the past I demonstrated how you could use TradingView Webhook Alerts to even automatically execute a trade. Perplexity alerts are even more powerful in that not only do you get an alert on numerical price data, you get the context of the news and events surrounding the price movement.

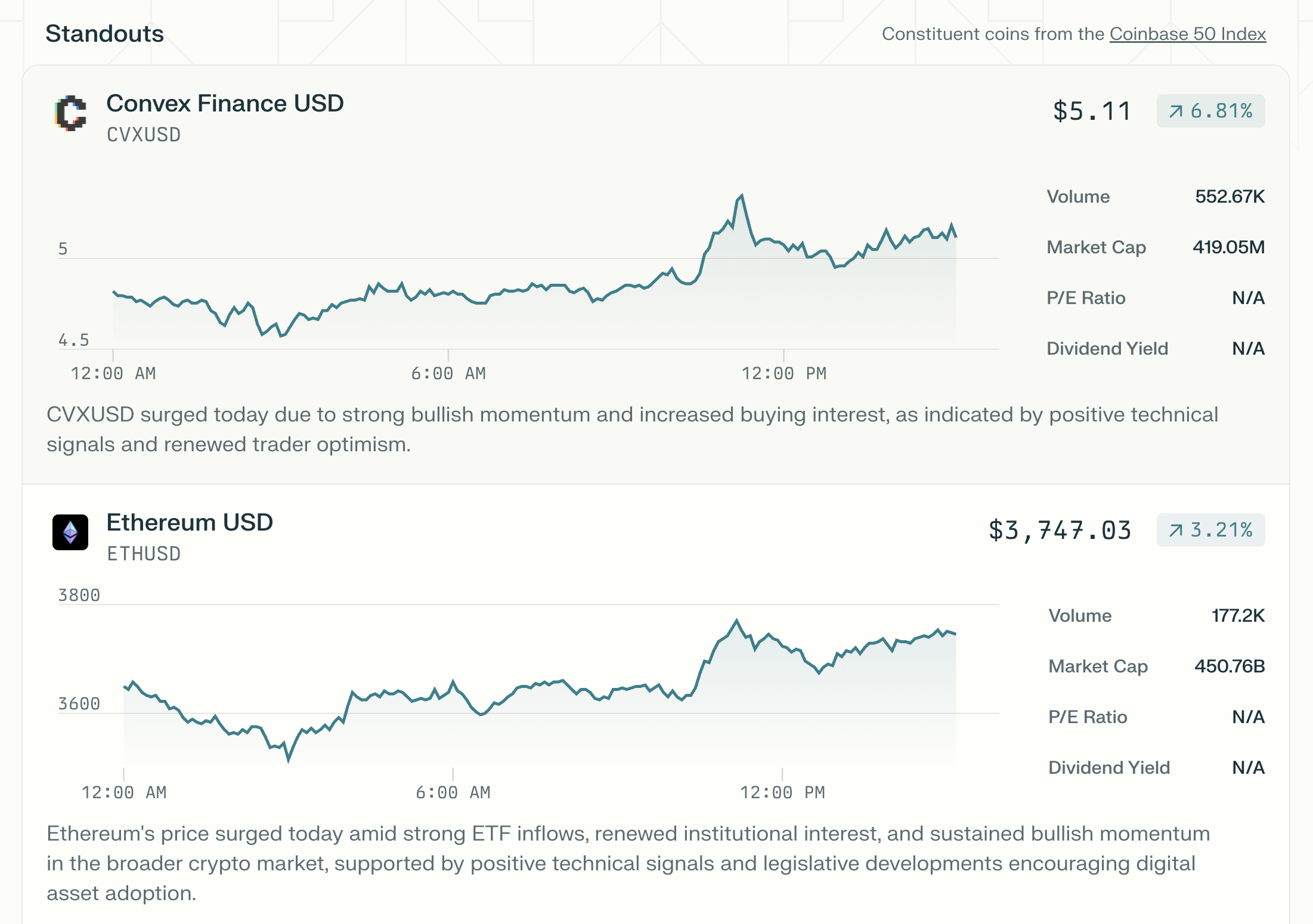

Coinbase Integration

The final feature I will touch on is the strategic partnership between Perplexity AI and Coinbase. This partnership provides real-time cryptocurrency market data and analytics within the Perplexity Finance interface. Phase one provides access to Coinbase’s proprietary market datasets, including the COIN50 crypto index, for live market tracking and price analysis.

Use Cases

- Analyze major cryptocurrencies and their market movements alongside equities and sectors.

- Use AI to screen for fresh trading opportunities and understand on-chain or token-specific developments

- Plan diversified strategies that bridge traditional and crypto assets, making Perplexity a one-stop shop for multi-asset research.

An upcoming phase will allow you to query crypto market data in natural language and receive AI-generated insights, with the potential for even deeper wallet and transaction integration in the future.

Wrapping Up

Perplexity Finance is shaping up to be one of the most versatile and forward-thinking tools in the modern investor’s toolkit. With real-time data, natural language querying, and AI-enhanced insights, it bridges the gap between raw market information and actionable intelligence. From the Earnings Hub and Live Transcripts to Perplexity Tasks, Price Alerts, and the new Coinbase integration, the platform is clearly evolving toward becoming an all-in-one research assistant for both traditional and crypto markets.

The prompts and workflows I’ve shared are just a starting point. What makes Perplexity truly powerful is how customizable and scalable it is for different investing styles, from retail to professional. And while there are still a few features I’d love to see added, like webhook support for automated workflows, the platform already offers an impressive edge for anyone who wants to stay informed without getting buried in dashboards or data feeds.

As AI continues to transform financial research, tools like Perplexity will only become more essential. The key is learning how to ask the right questions and setting up systems that help you get answers before the rest of the market does.