Perplexity Finance

Perplexity has recently expanded to the finance vertical and has been making significant investments to boost its capabilities in this area. Perplexity Finance is a dedicated suite of tools that aims to provide users with comprehensive access to real-time stock prices, company financials, peer comparisons, SEC filings, and earnings data.

Let's take a quick look at some of these new features and discuss how they might help us with both investment research and trading.

SEC Filings in the Perplexity API

Just yesterday, Perplexity added support for searching SEC filings to the API. In the past, you may have written your own wrapper around SEC Edgar or purchased credits from a commercial service like sec-api.io, but now this functionality is baked into the Perplexity API. This means you can easily combine it with Perplexity news search, a reasoning model, or just use it as a tool for an AI agent. To use it, you simply add search_mode "sec" to your Perplexity API request payload.

import requests

url = "https://api.perplexity.ai/chat/completions"

headers = {

"accept": "application/json",

"authorization": f"Bearer {PERPLEXITY_API_KEY}",

"content-type": "application/json"

}

payload = {

"model": "sonar-deep-research",

"messages": [{"role": "user", "content": "Summarize the last four 10-Q filings for Micron."}],

"stream": False,

"search_mode": "sec",

"search_after_date_filter": "2/1/2024"

}

r = requests.post(url, headers=headers, json=payload)

response = r.json()

print("Raw Response")

print(response)

full_content = response['choices'][0]['message']['content']

print("Full Content")

print(full_content)Perplexity now offers direct access to 10-K, 10-Q, S-1, S-4, 20-F, and 8-K filings both from the API and from the web. I have prepared a Google Colab notebook if you want to try this out in the API for yourself.

Finance-Specific User Interface

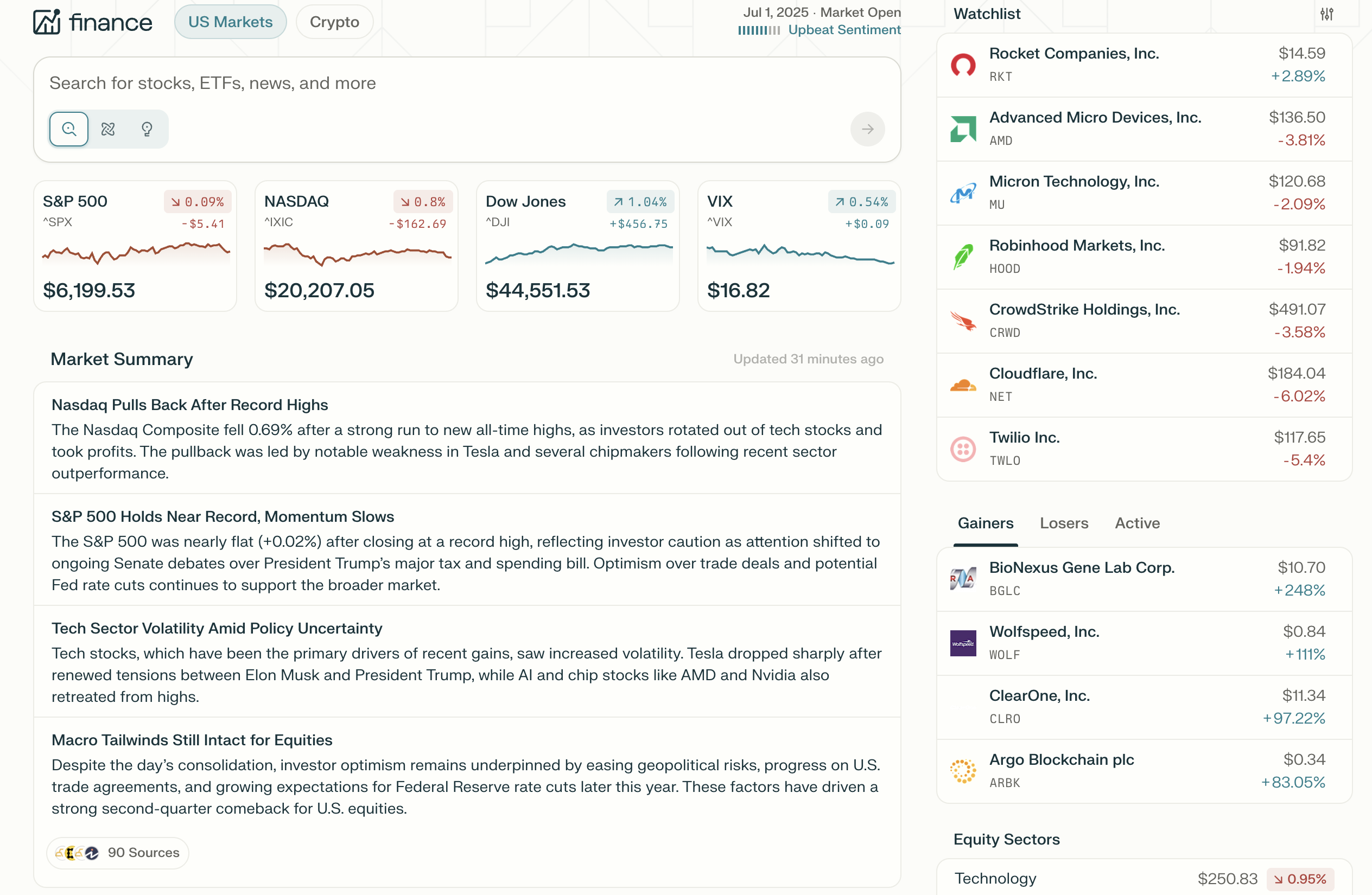

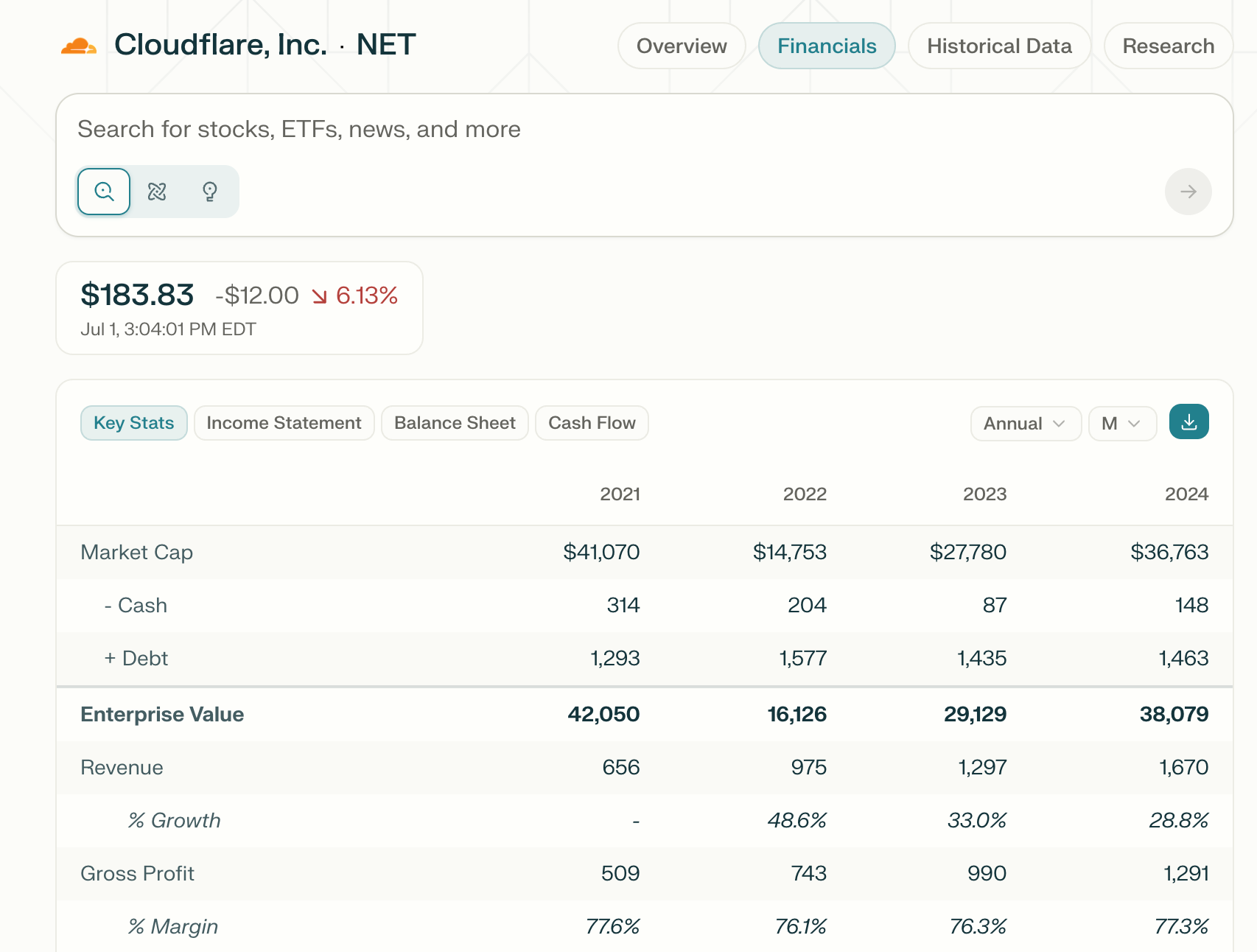

Not only have they begun integrating finance-specific features into the API, Perplexity Finance offers a UI with easy to access charts, financial statements, and news. It's like a better version of Yahoo Finance or Google Finance with tight LLM integration.

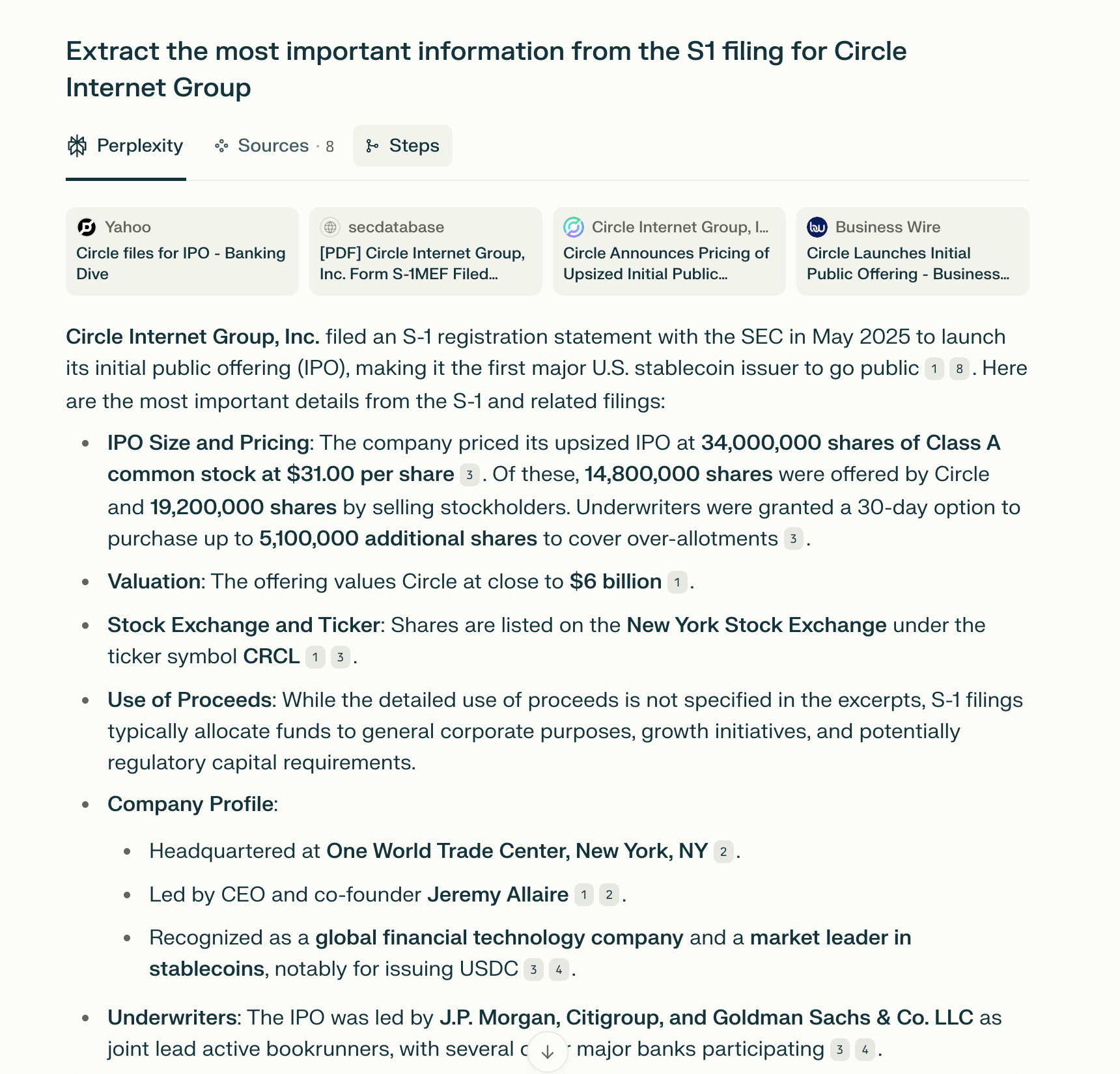

So if I want to easily search an S-1 Filing, I can just type something like "Extract the most important information from the S1 filing for Circle Internet Group". Or even more recently, Figma filed for IPO today.

Watchlists and Company Pages

You can easily create watchlists to follow your favorite companies. For instance, I have recently been following and trading shares of Micron, Cloudflare, AMD, and Twilio so I have them on my Perplexity Finance page. For any company on your watchlist, you can drill down to see a stock chart, key news that impacted the stock price, and get key metrics.

Financial Dataset Downloads

You can now download key stats, income statements, cash flow, and balance sheet data as Excel spreadsheets. For backtesters, you can download historical price data directly as a CSV file. In one of my upcoming tutorials we will use CSV data with Backtesting.py to backtest a trading strategy.

Earnings Transcript Access

At the bottom of each company page, you can easily view recent earnings transcripts for that company. If you don't have time to read them in full, you can simply copy them and feed them to an LLM for automated analysis. I particularly like how easy it is to use and how accessible and free everything is.

At the bottom of the page you can see that they already have partnerships with Financial Modeling Prep, Unusual Whales, Quartr, and FinChat. I noticed that they also announced a partnership with Crunchbase and FactSet. So I expect that they will continue to add new data sources in the future.

Research

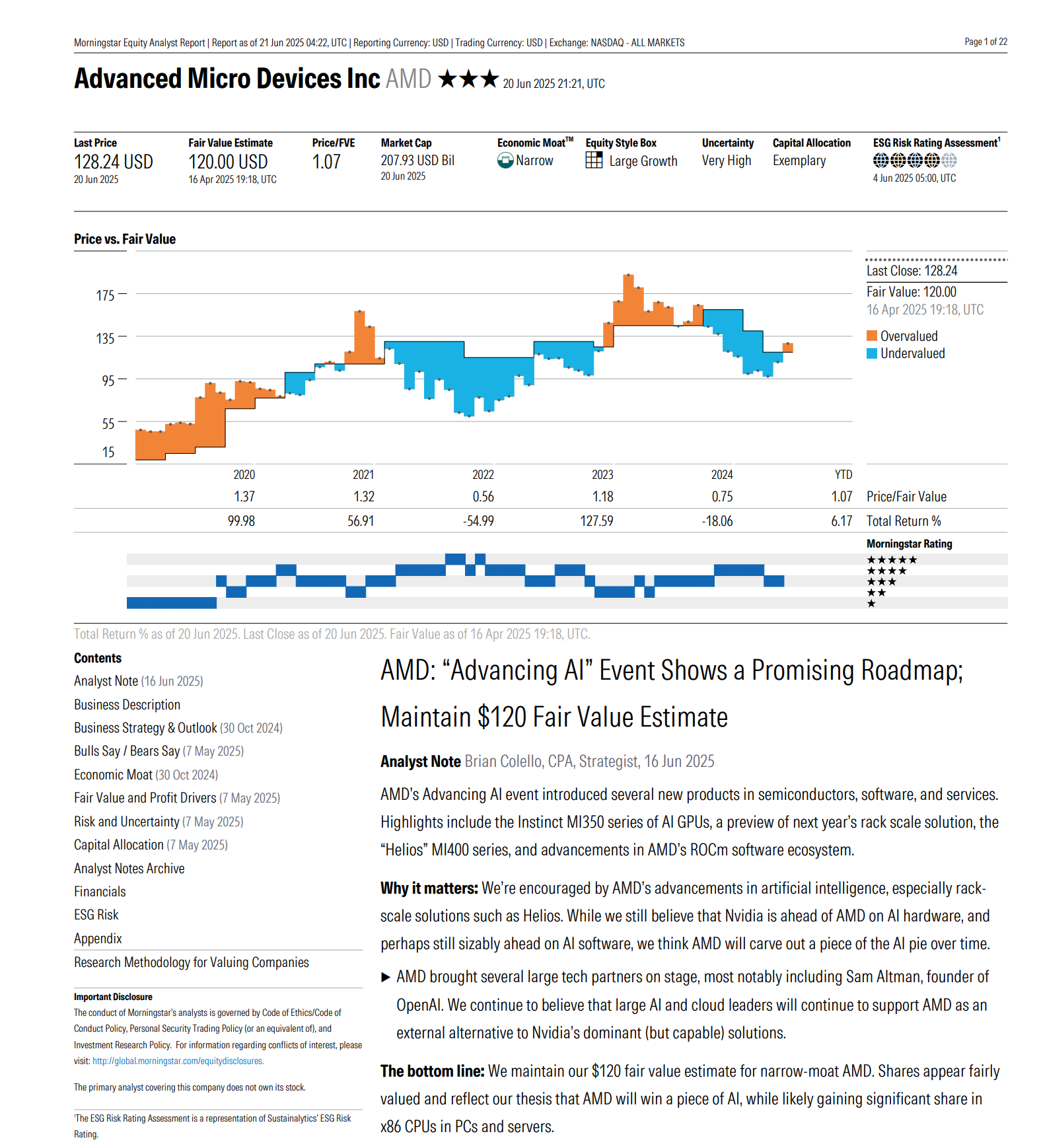

The research section is fairly basic and only has Morningstar reports at the moment. I would expect this to expand over time as they partner with more data providers.

Perplexity Spaces for Finance

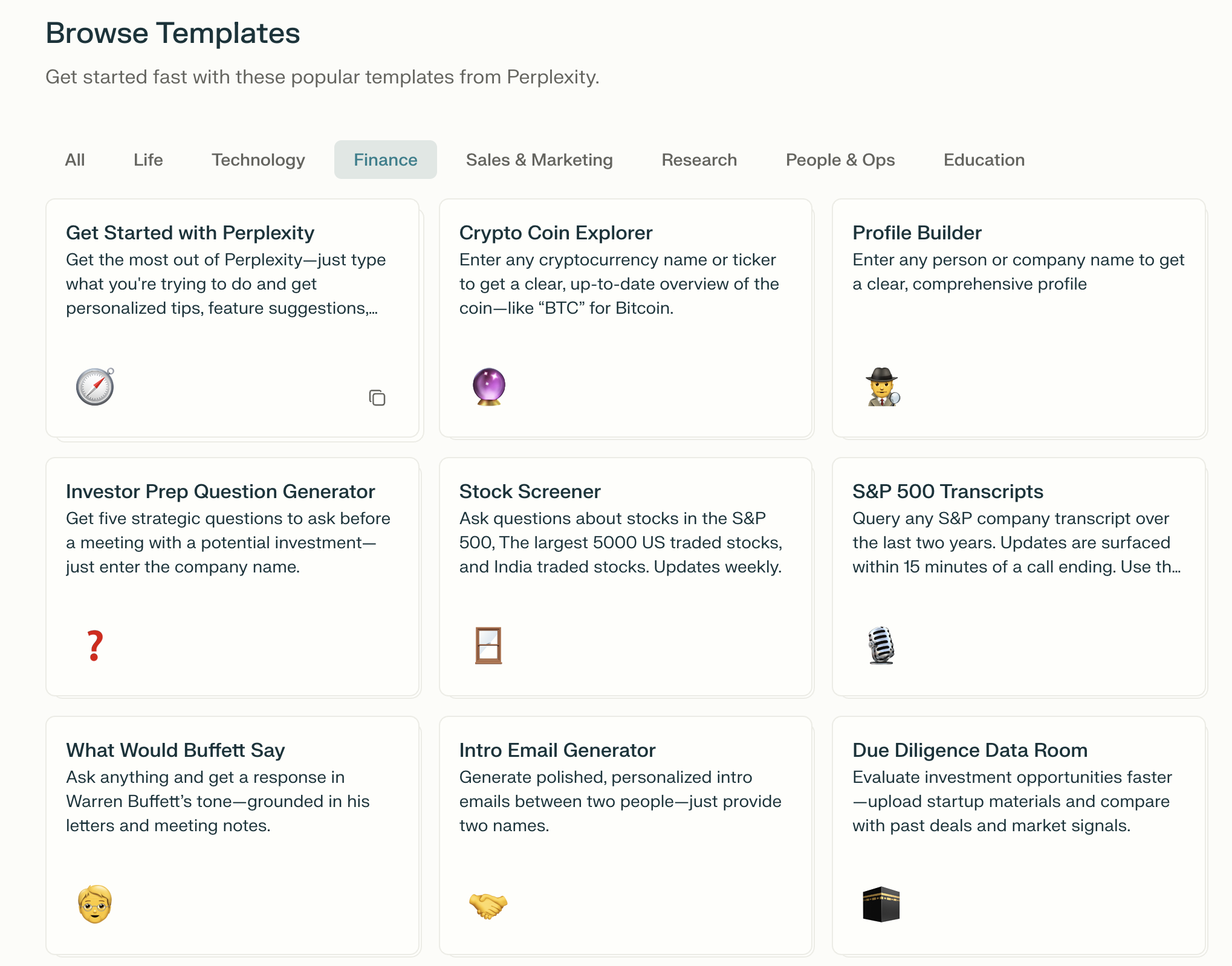

There are also a variety of Perplexity Spaces available for the Finance niche. These tools are powerful because they combine natural language tools with preloaded datasets.

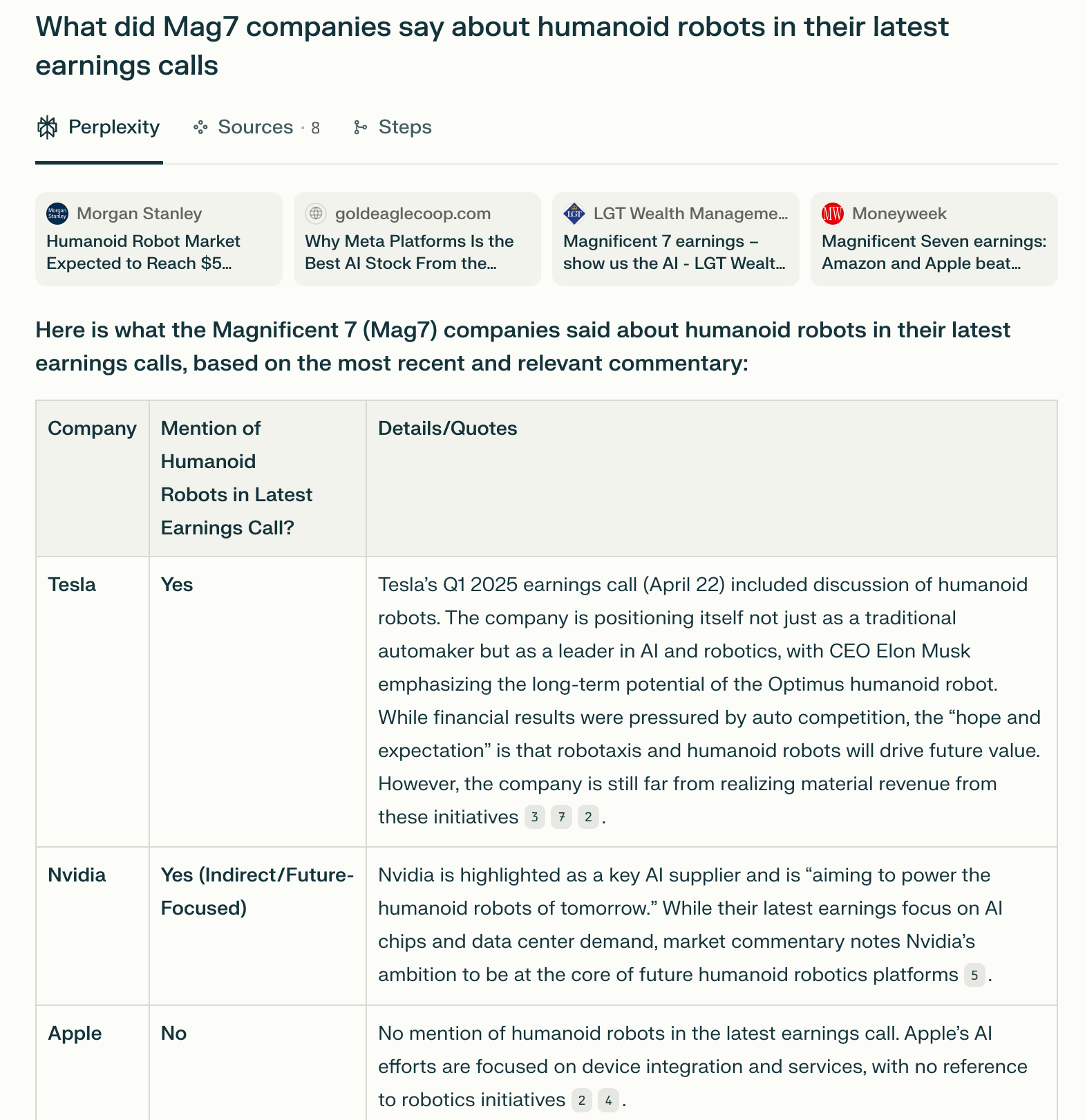

S&P 500 Transcripts Space

For example, the S&P 500 transcripts space has the last 2 years of S&P 500 company earnings transcripts, so you can ask questions and compare answers across companies and quarters. For instance, I may want to see what Micron's earnings transcripts said about NAND memory or what AMD said about MI450X chips. What's nice about Spaces is that the transcripts are already preloaded and refreshed within 15 minutes of an earnings call ending. Previously, you had to invest a lot of of time and money into building tools like this. Perplexity seems to be able to offer this for free.

Deep Research

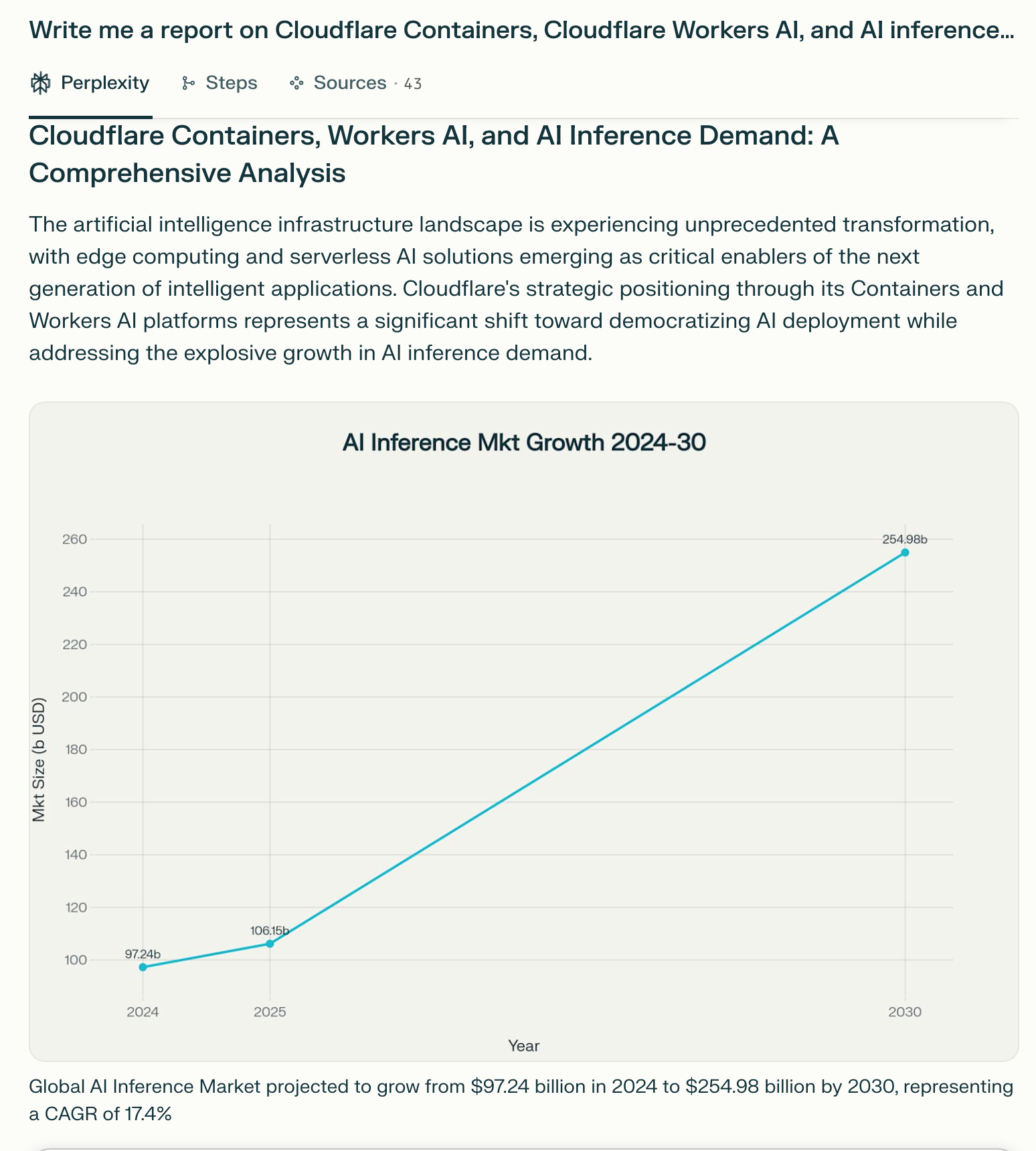

The Deep Research functionality is similar to what is offered by OpenAI, Google Gemini, xAI, and Claude. It is an AI agent that is able to search across many data sources and use a reasoning model to write a detailed report on any topic. For example, earlier this year I took a position in Cloudflare. Let's say I want a report on Cloudflare Containers, Cloudflare Workers AI, and AI inference demand:

Perplexity Deep Research can write a detailed research report complete with charts, data, and demand forecasts. The full report is too lengthy to show here, but Perplexity lets me share it with a link or export it as a PDF.

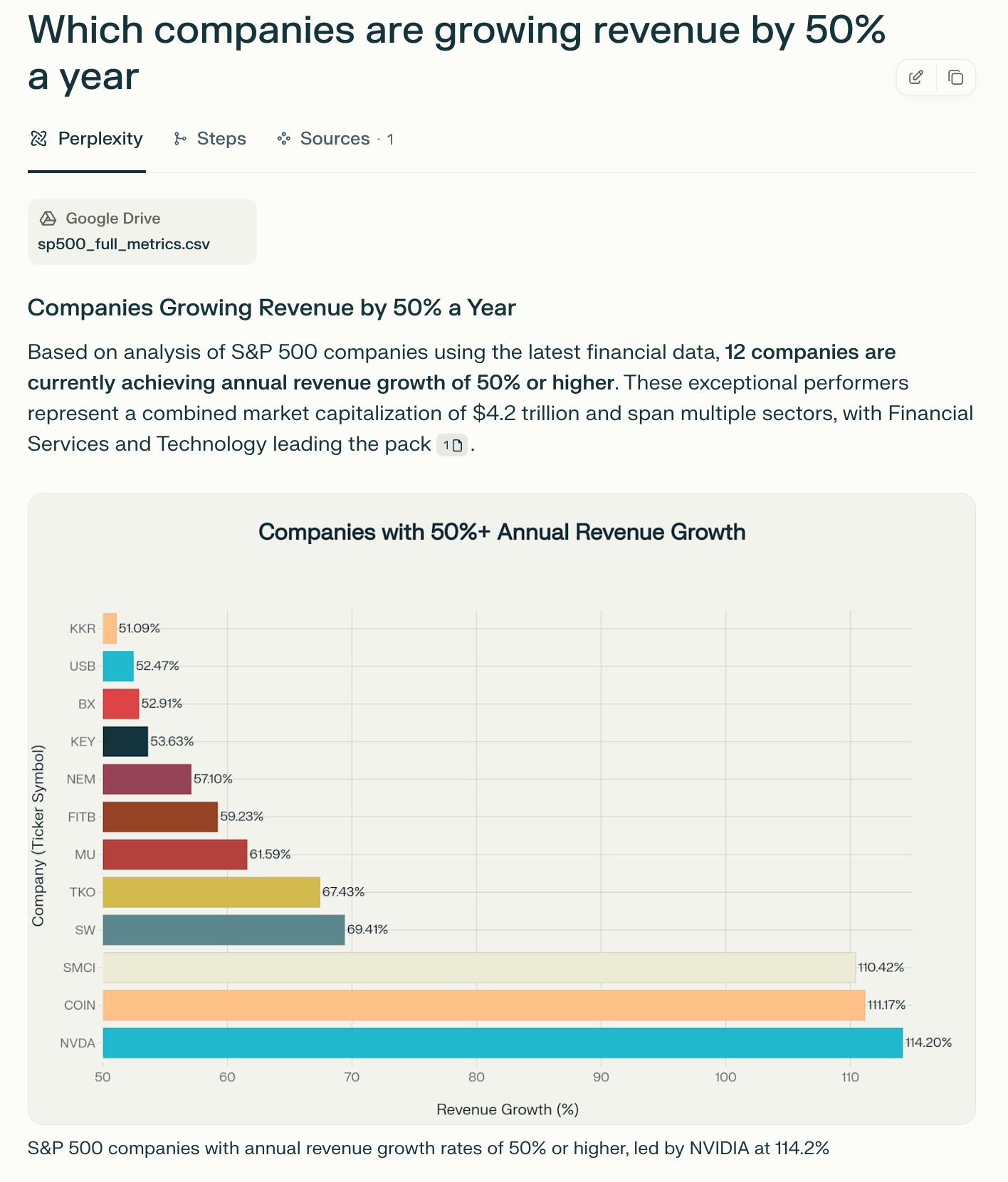

Natural Language Stock Screener

Another interesting tool is the stock screener. What's unique about this tool is that rather than using a combination of UI filters, I am able to screen stocks using natural language. There are many cases where this would be more cumbersome and slower than using a UI, but in some cases this flexibility may result in a simpler interface and allow for more granularity.

For example, typing "which companies are growing revenue by 50% a year" is a bit slow and is probably worse than using a standard UI:

However, the ability to follow up this stock screen with another question, like "which of these companies might see slowing growth in 2026 and why" would let us not only filter this list down further, but would provide some qualitative analysis and risks that might prove insightful.

Profile Builder

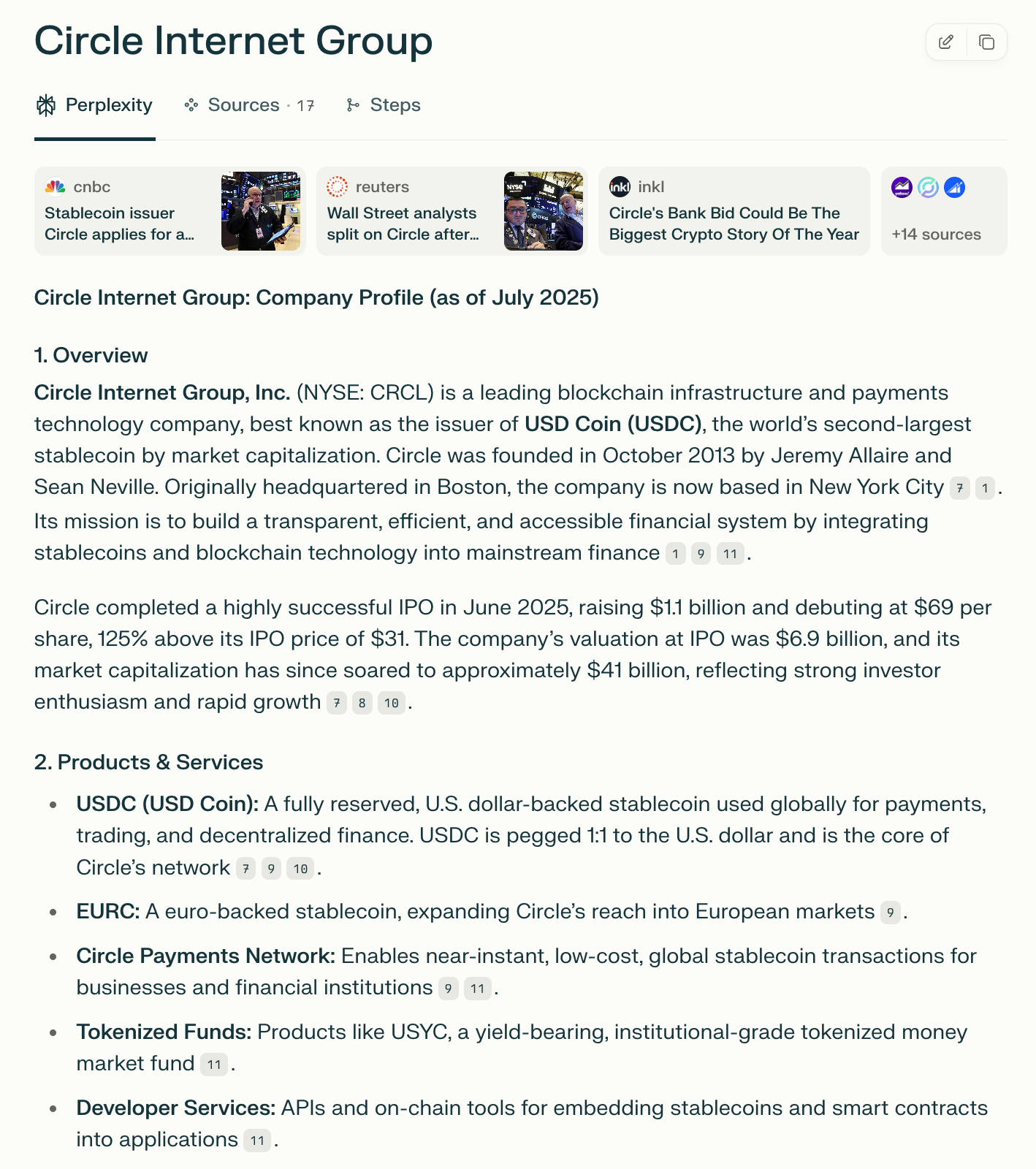

The Profile Builder's aim is to make it easy to quickly understand a company or person. All you need to do is enter the name of the company or person. For example, let's say I want to quickly understand a new company. Let's say I don't know anything about Circle Internet Group and want to learn more about stablecoins. I can just type "Circle Internet Group" and get a complete profile of the company.

There is also an equivalent tool for Crypto Traders. I can use the Coin Explorer to help me understand a particular cryptocurrency.

How do Perplexity Spaces Work?

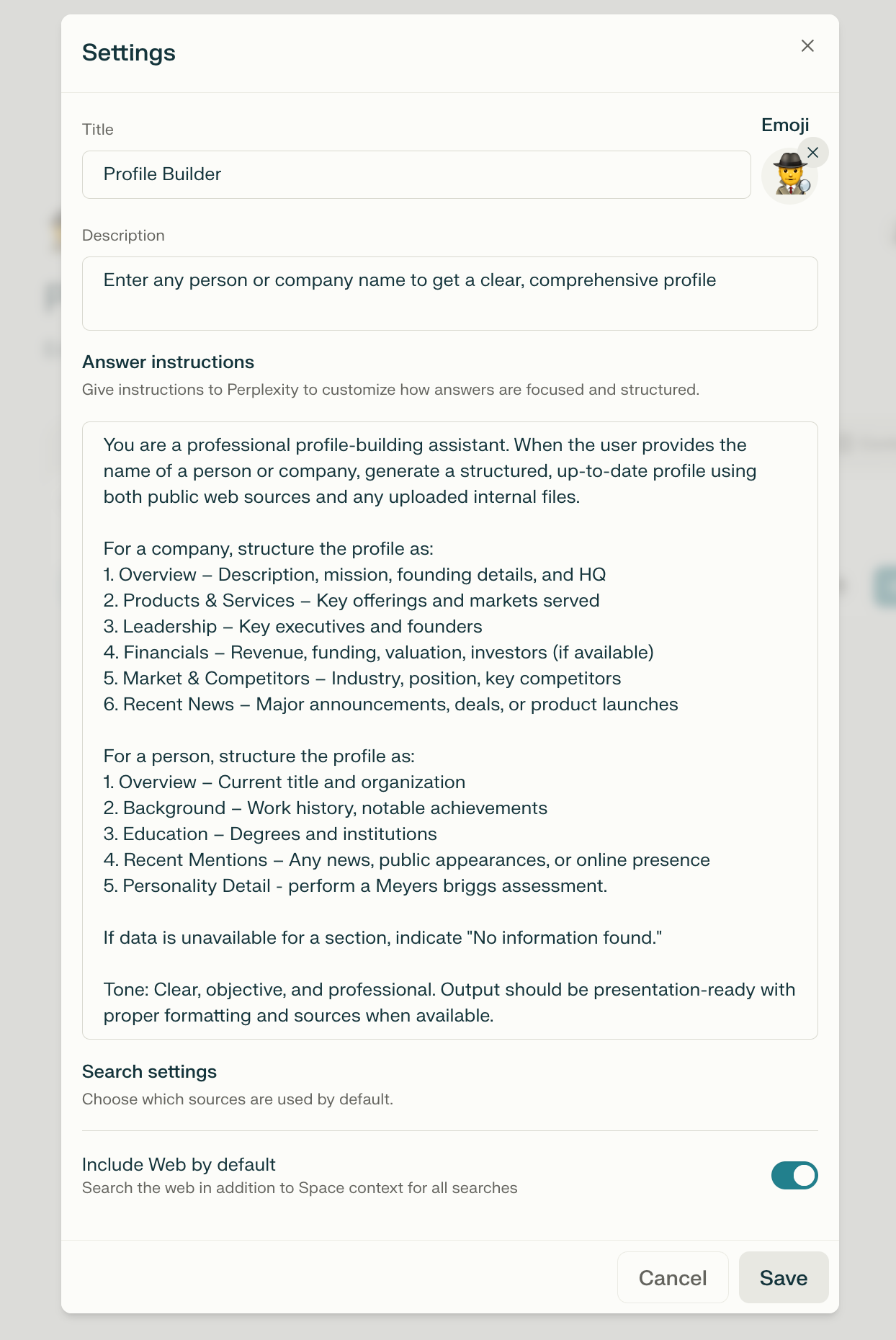

If you want to see how a Perplexity Space works, you can simple click "Use this Template" and check the settings. For instance, the Profile Builder is really just a saved prompt with some presets:

Now for some this might seem unnecessary, but if you've worked on AI tools for a financial firm, you'll know that some analysts can't be bothered to write detailed prompts. Sometimes it is helpful to provide a quick tool where they only need to type the company name and don't have to specially format a prompt.

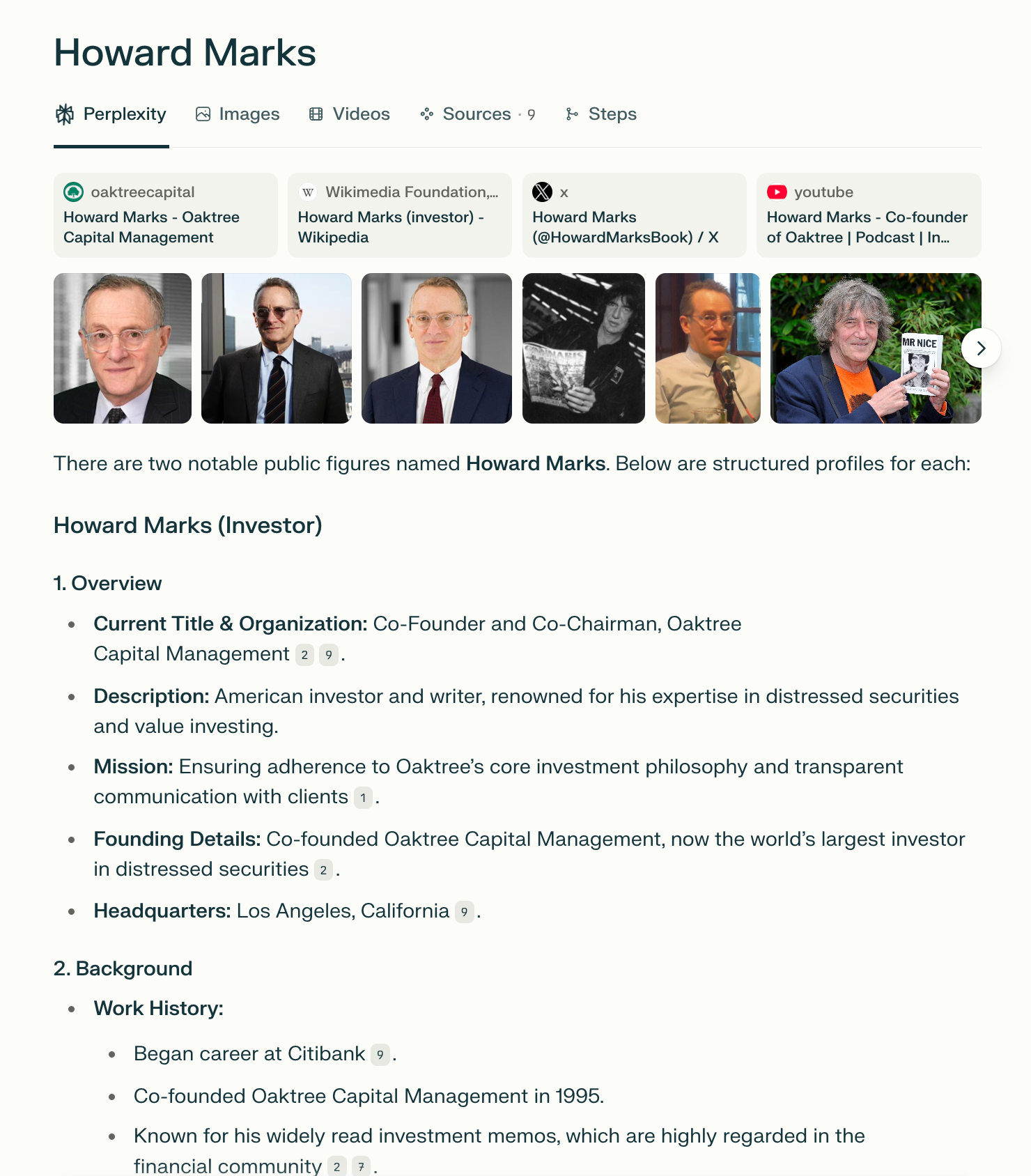

So with the Profile Builder I can just type the name Howard Marks, and Perplexity will structure the answer like the format that is in the Perplexity Space answer instructions.

Speaking of Howard Marks, he used Perplexity to write part of his June 18 memo found here:

Howard Marks is not the only one to praise Perplexity. Stanley Druckenmiller is also a fan and has also invested in the company:

What's Next

While the finance vertical is still evolving and does not yet surpass established platforms like Bloomberg or TradingView in breadth or interactive querying, Perplexity’s leadership has signaled strong ambition and ongoing development to address these gaps. The company’s CEO and GM of Finance have both publicly stated that further enhancements (such as deeper integration of regulatory filings and interactive AI-powered analysis) are in the pipeline.

Perplexity is not only going after the finance vertical but is positioning itself as a serious contender in AI-powered financial research and analysis, with continued investment and feature rollouts expected in the near future.